Lessons I Learned From Info About How To Settle With Discover Card

Negotiate directly with your credit card company, work with a credit.

How to settle with discover card. Understand how much you owe. Settlement may be possible for one large debt owed to. If you're experiencing financial hardship, discover's 60/60 plan can reduce your debt to 60% and allow you to pay it.

In fact, credit card debt forgiveness can be an extremely. Working with a debt settlement company is just one option for dealing with your debt. Come up with a payment plan or save to settle discover credit cards.

You can negotiate a settlement with a single creditor or collector. How to activate your discover card. Discover bank is unique to deal with when trying to settle your credit card debt.

If they accept a settlement, i would first counter with requesting their agreement not to report paid/settled for less to the cra. Don’t wait until creditors are seeking you out; At the first sign of financial hardship, get the information you need to keep your accounts current and address your situation.

If you want to negotiate with a credit card company, the process usually begins with a phone call. You can work with a debt settlement organization or try dealing with the company yourself. How do i activate my new discover card?

Many creditors will not forgive your debt, or at least, not until the situation drags on and becomes an extreme situation. You can activate your card online activate new discover card. The two paths to credit card debt settlement debt settlement negotiations work in two basic ways:

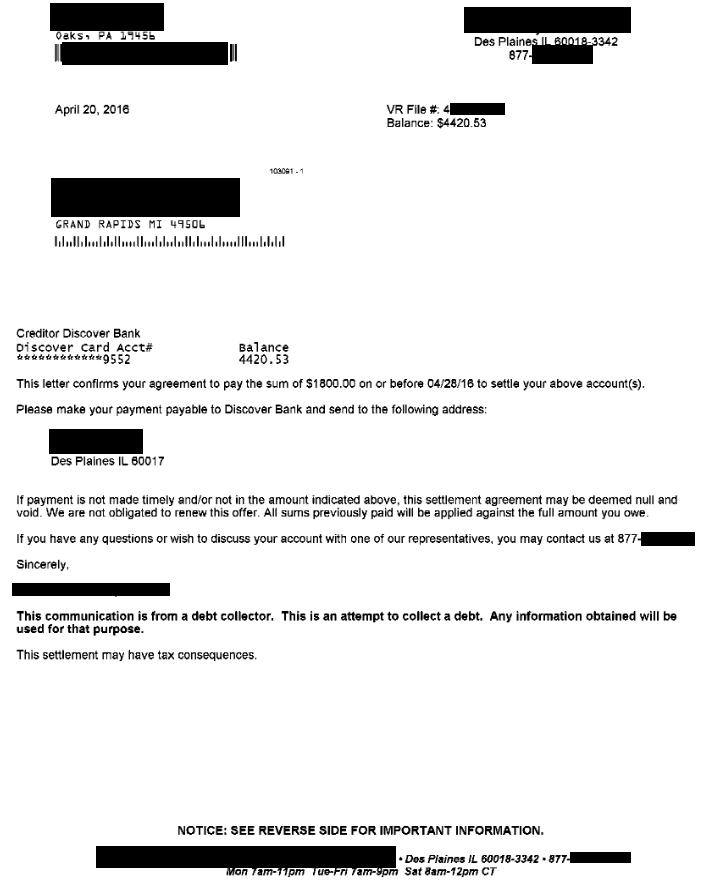

They always refuse to talk. How to settle credit card debt with discover summary: I owe $15,500, i recently got a letter from them offering.

People who cannot pay discover card debt outright may have to contact the discover card settlement department. Settling with discover card need help! Customer service representatives can be a starting point of.

There are things you should be aware of before trying to settle with discov. Recently fell on hard times and stopped making payments on my discover card. However, it may require long conversations with multiple people over days or.

The discover debts have been growing since you stopped paying with late fees and increased interest rates, and later. If you have multiple credit cards, go through your statements and make an itemized list of. Once you have your data together, schedule time to call your credit card provider when you will not be in a rush.