What Everybody Ought To Know About How To Improve Your Credit Score After Bankruptcy

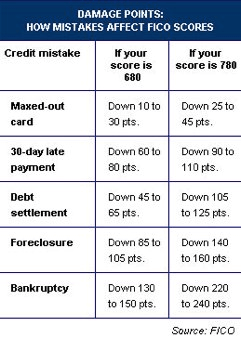

It is common for people’s credit scores to drop by 200 points or more following a bankruptcy filing.

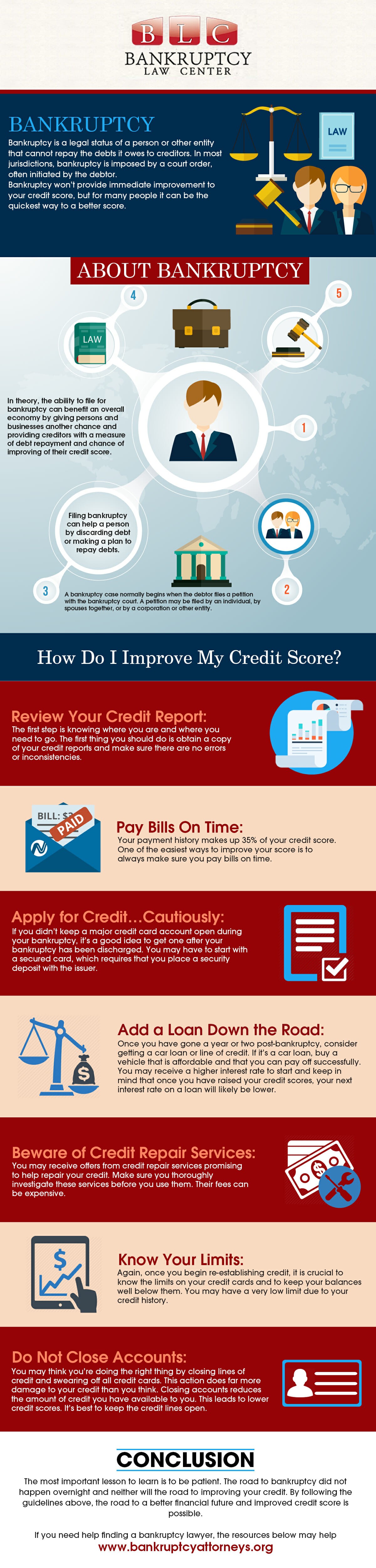

How to improve your credit score after bankruptcy. Your credit scores may improve when your bankruptcy is removed from your credit report, but you'll need to request a new credit score after its removal in order to see any. Request three free credit reports and check that the balance is zero. Bankruptcy will only exacerbate your existing credit issues.

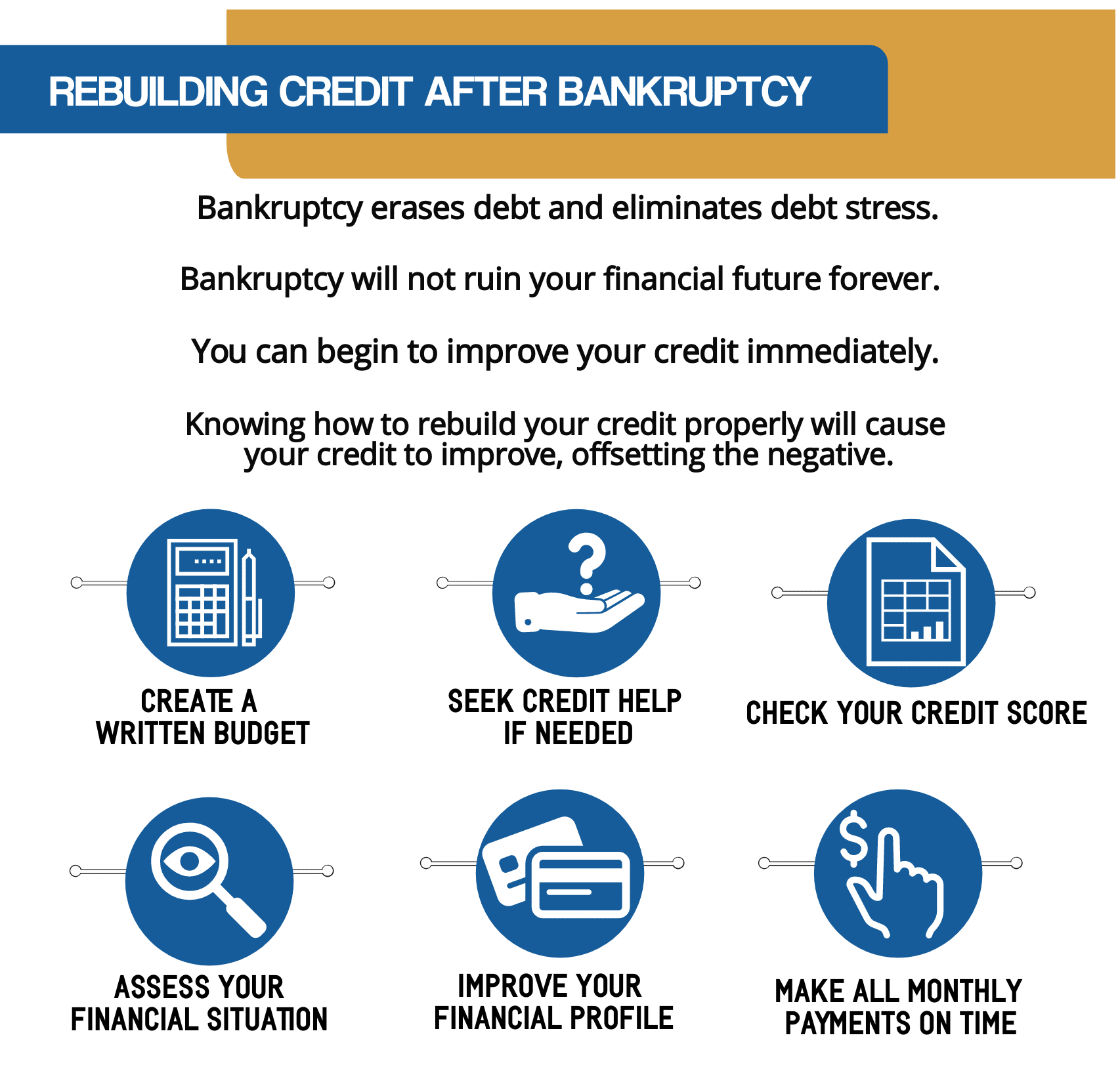

Never has debt relief been more helpful and never has great credit after bankruptcy been so easy to attain. When you stick to these principles, your credit can recover from any setback:. Your bankruptcy will appear on your credit report for up.

Practicing good financial habits is the key to building excellent credit after a bankruptcy. However, your credit score will typically rebound in a few months if you continue. See our top 5 rated services and improve your credit score.

They should be marked as discharged and show zero balances. Do not close any credit cards simply because you were once bankrupt. Take advantage of these autopay features.

Become an authorized user on someone elses card if you have a relative or friend who has really good credit and. Reduce debt by up to 50%. A person's bureau score drops after filing for bankruptcy, and a low bureau score makes getting new credit impossible.

You need to pull your credit reports to check on your bankruptcy debt discharges. One of the easiest ways to improve your score is to always make sure you pay bills on time. However, you can legally get a loan after bankruptcy.

Another way for you to get a credit card after bankruptcy is to become an authorized user on a card account belonging to someone else, such as a partner, parent or. Help from bbb a+ accredited team. Find a card offer now.

Ad consolidate your debt and experience financial freedom. To rebuild your credit score, you should: Find a card with features you want.

It’s important to note that your credit score will decrease when you open new accounts. Ad responsible card use may help you build up fair or average credit. Bankruptcy can stay on your credit report for up to 10 years, and your credit score will probably be pretty low after a bankruptcy.

After a bankruptcy it can be difficult to near impossible to get credit, but there is hope, you can improve your credit score over time. In my opinion, paying your bills on time and never being late is the best way to improve your credit score after bankruptcy. A bankruptcy can remain on your credit report for up to 10 years, and there is a good chance your fico score will be low until you have started rebuilding your credit.