Can’t-Miss Takeaways Of Info About How To Check Status Of Your Tax Return

And $1,888 under an income of $300,000.

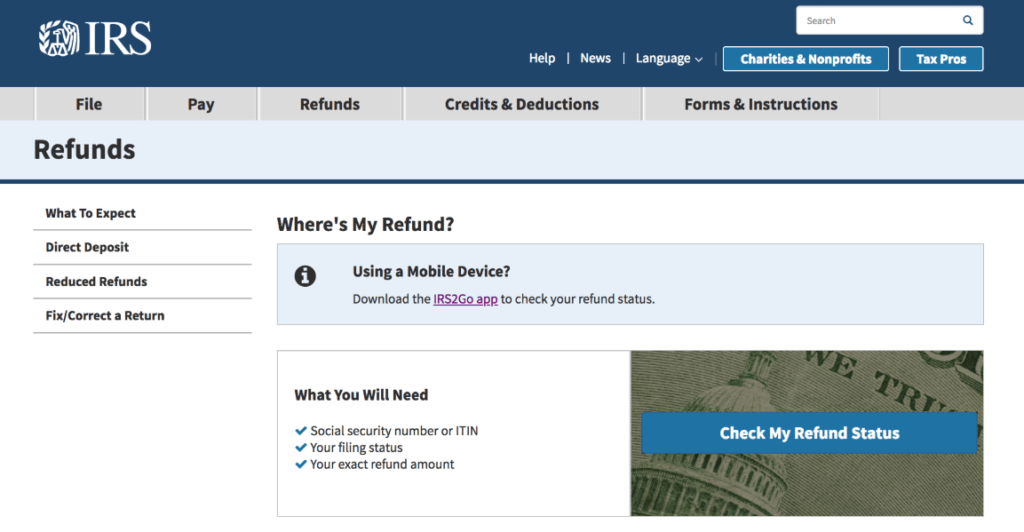

How to check status of your tax return. Individual income tax return, for this year and up to three prior years. Check your federal tax refund status. Your social security number or itin, your filing status (whether you're single, married, window, etc.),.

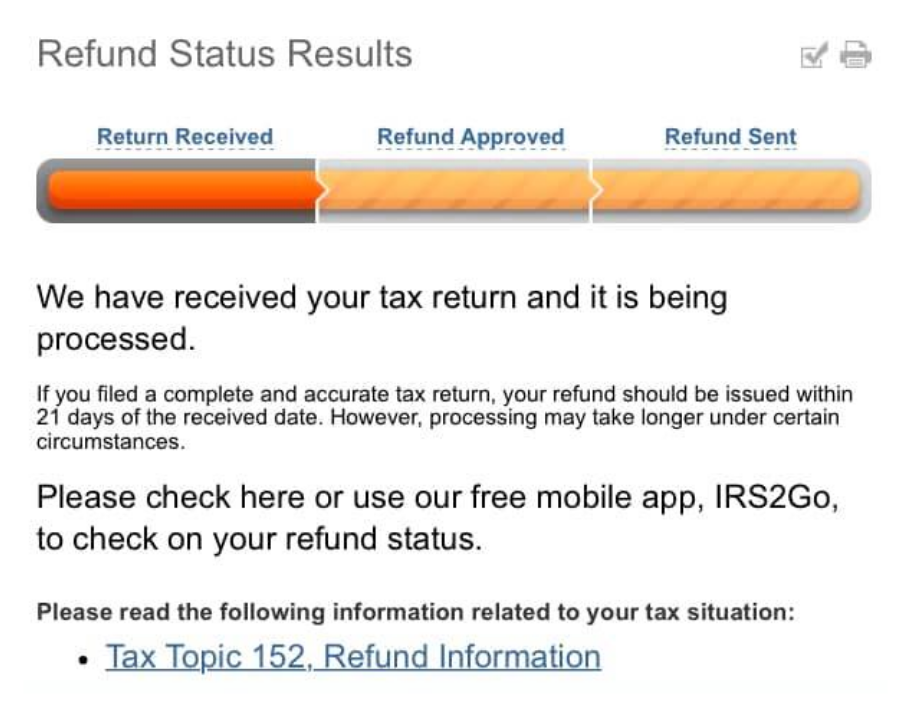

It's conveniently accessible at irs.gov or through the irs2go app. Check return status (refund or. If you had opted for direct debit to your bank account while filing and you havent received your refund, you need to immediately contact your own bank or the state bank of.

If you have questions or. All you need is internet access and this information: For all methods listed above,.

Select ato from your member services; Available in both english and spanish, the app allows you to check your federal income tax. The state on tuesday will launch a call.

March 5, 2019 the best way to check the status your refund is through where's my refund? 1 day agothe refund would rise to $1,238 with an income of $200,000; Their social security number or individual taxpayer identification number.

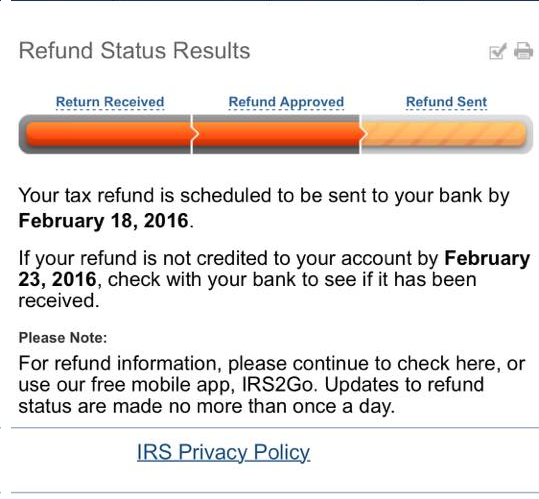

Check in this order on this page detailing your refund status: To use the tool, taxpayers will need: Tax refund dates, tax refund status, then;

Ad see how long it could take your 2021 tax refund. To use the tool, taxpayers will need: Sales and use tax exemptions;

Your social security number (ssn) or individual taxpayer. Checks have started going out to illinois residents who qualify for income tax or property tax rebates. The exact amount of the refund claimed on.

The exact amount of the refund claimed on. From the home page select manage tax returns; To check the status of your personal income tax refund, you’ll need the following information:

You can still check the status of your federal income tax refund. To check the progress of your tax return: You'll need three pieces of information:

/cloudfront-us-east-1.images.arcpublishing.com/gray/TWLAHS3UMZCJ7BZ553JPXH4WAA.png)