Divine Tips About How To Buy Treasury Inflation Protected Securities

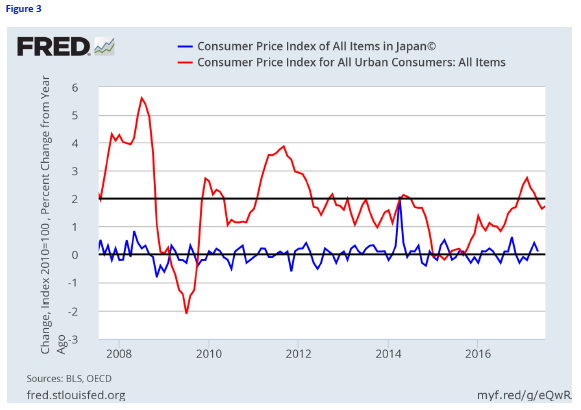

When inflation rises, the tips'.

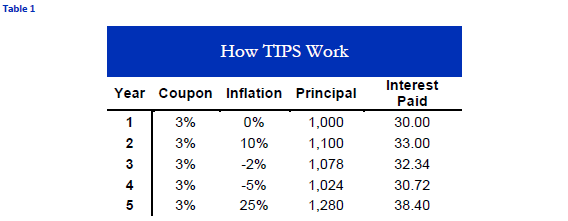

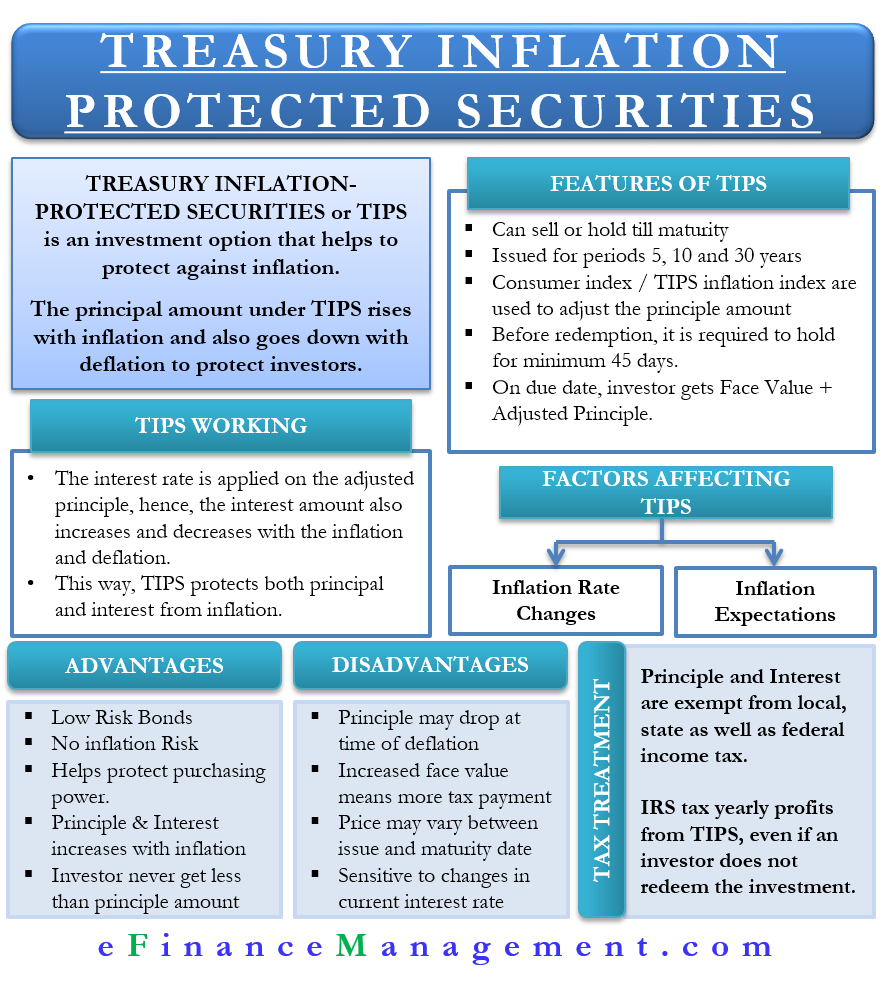

How to buy treasury inflation protected securities. When inflation rises or falls, the principal value. Additionally, treasury bonds, including tips, can be purchased. Treasury inflation protected securities (tips) refer to a treasury security that is indexed to inflation in order to protect.

Government that offer protection against inflation, in addition to modest interest payments. Additionally, treasury bonds, including tips, can be. You can purchase tips from the u.s.

Treasury inflation protected securities (tips) are bonds issued by the u.s. Treasury bills, treasury notes, treasury bonds, and treasury inflation protected securities (tips). The breakeven amount is the difference in yields.

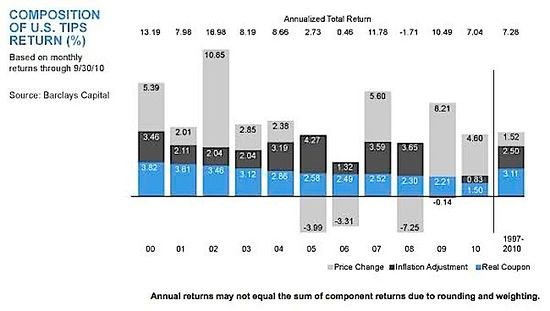

When inflation outpaces the breakeven point of normal bonds, it’s usually the right time to switch to tips. If you invest in a tips mutual fund or etf, you'll receive interest. (tips) can be purchased through any broker, brokerage account or mutual fund.

Treasury bond designed to help investors protect against inflation.they are indexed to inflation, have u.s. There are four types of marketable treasury securities: Vanguard treasury money market fund, yielding 1.11%;

Treasury security whose principal value is indexed to the rate of inflation. Direct owners of tips would have to reinvest their interest payments in other tips to enjoy similar benefits. Treasury or through a bank, broker, or dealer.

Treasury inflation protected securities (tips) can be purchased through any broker, brokerage account or mutual fund. The principal of a tips increases with inflation and decreases with deflation, as.

:max_bytes(150000):strip_icc()/dotdash_INV_final-Introduction-to-Inflation-Protected-Securities_Mar_2021-01-6c9fb72cb0d448d8ae2e68a37c58123c.jpg)

:max_bytes(150000):strip_icc():gifv()/terms_t_tips_FINAL-e13504d282ae4415a974701ece9fcf5e.jpg)