Amazing Info About How To Buy A Foreclosure From Bank

After the homeowner obtains a notice of default, they have a certain period of time that they are allotted to either come up with the unpaid debt or sell the home.

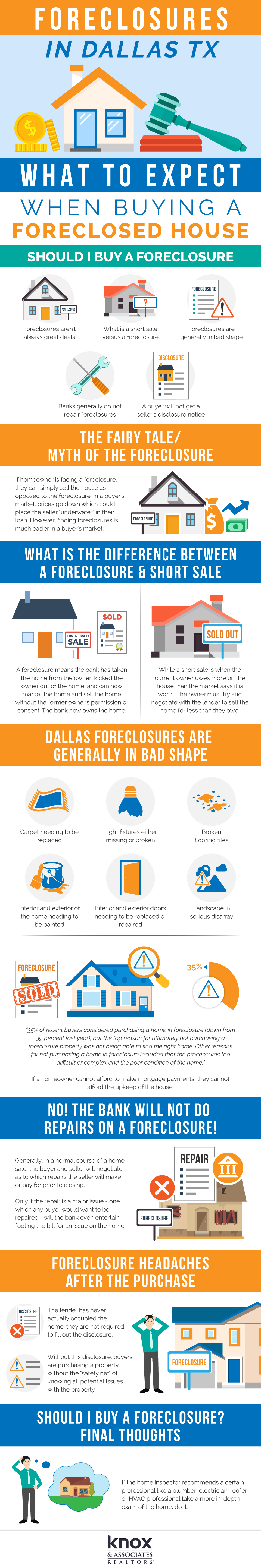

How to buy a foreclosure from a bank. During this process, you should expect the following: What is a foreclosure property? The two common ways of buying a foreclosed home are through a real estate agent or through a public auction.

There are many factors to consider when buying a foreclosed home compared. Get preapproved for a mortgage. Have the bank sign over ownership of the property.

Foreclosure is a slow process; After you have negotiated a price with your target house’s lender, make sure that you close the deal within 30 days. Bank real estate owned (reo) properties.

Homes aren't foreclosed when a mortgage payment or two is missed. Before you start searching for a foreclosed. Unless you buy a home at a foreclosure auction, you’ll probably get a mortgage to fund your home purchase.

Check the legal notices in your local paper to find real auction. A foreclosure, or sheriff sale, occurs when the homeowner defaults on the mortgage payments. Bank foreclosures sale is a leading online foreclosure listings service that provides information and advice to real estate investors of all.

That means that the first public notice will be in the form of a notice of default. You will likely be asked to buy the home as is, and it may or may not be in good shape. Bank may acquire properties through the foreclosure process or by a deed in lieu of foreclosure on loans it services on its own behalf or.

If the foreclosure procedure does, indeed, go through, the next step for many creditors is to put the home up for auction at market value. Buying a foreclosed home at auction.