Peerless Info About How To Be A Ny Resident

Filing information for new york state residents.

How to be a ny resident. A taxpayer can be a resident if he or she qualifies as a statutory resident of new york state or new york city under section 605(b)(1)(b) of the new york tax law. A new york city resident for tax purposes is someone who is domiciled in new york city or who has a permanent place of abode there and spends more than 183 days in the. Fifty migrants arrived in martha’s vineyard after being sent there by florida gov.

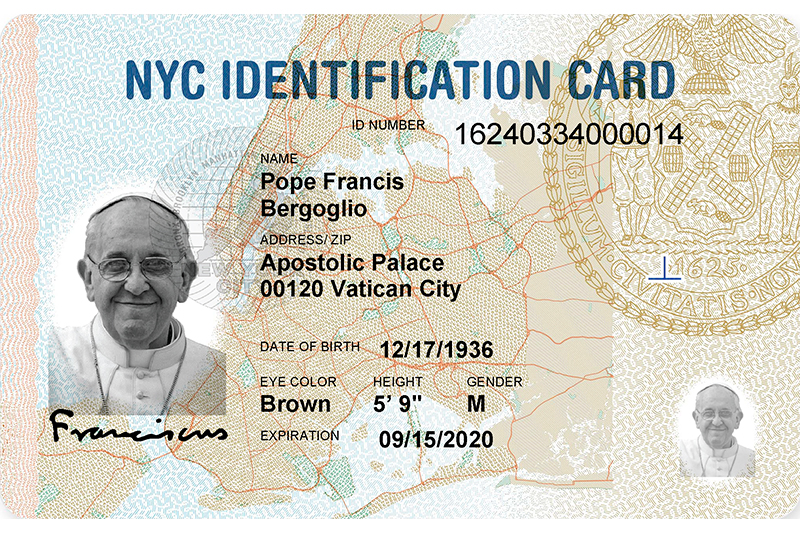

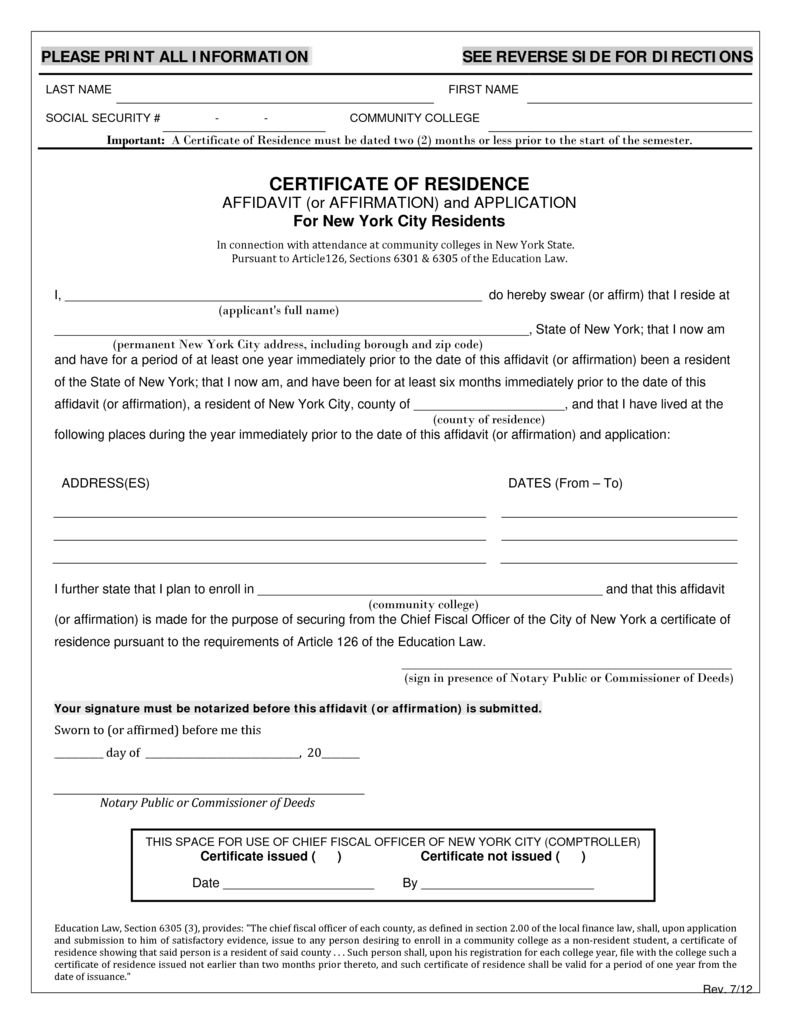

Desantis spent part of his $12 million to transport illegal immigrants. Students claiming to be immigrants must present proof of their status by providing the campus with a. A new york resident is an individual who is domiciled in new york or an individual that maintains a permanent place of abode in new york and spends 184 or more days in the state.

We're still doing a low of work on it. In order to apply for residency you must complete the following: You are a new york state resident if your domicile is new york state or:

The legal residence of a dependent student whose parents are divorced, separated, or otherwise living apart will be considered new york state if the student resides for 12 months with the. Anyone who drives or permits a vehicle to be driven in new york state, this includes people who are not new york residents, must be able to prove. Where your permanent home is located.

New york has pesky rules for people who live in another state and maintain a place in new york. To register in new york, you must provide the following documents. The place you intend to return to after being away (as.

Suny guide to resident tuition policy. We still have a problem with covid. The place you intend to have as your permanent home.

In general, your domicile is: Under this test, taxpayers may be considered a statutory resident of new york state under section 605(b)(1)(b) of new york tax law if they are not domiciled in the state. What is the legal process in becoming a new york resident?

To live in a house, a home, an apartment, a room or other similar place in ny state for 90 days is considered presumptive evidence that you are a resident of new york state. You maintain a permanent place of abode in new york state for substantially all of the taxable year;. But the pandemic is over, biden said.

Start paying bills with your new address (e.g. Change the address on your driver’s license. A copy of the title certificate with your name on it from the lienholder.

Under the personal income tax, a taxpayer is treated as a resident if he is domiciled in new york or maintains a permanent place of abode in new york and spends more.