Fabulous Tips About How To Avoid Predatory Lending

One of the easiest ways of avoiding predatory lenders is to go with a reputable mortgage lender.

How to avoid predatory lending. Predatory loans lure you in with benefits that are too good to be true, then you get hit with high costs and impossible repayment terms. This guide will explain all of that, as well as. Tthe united states attorney's office has made combating predatory lending a priority.

Tip to avoid overpriced car loans: • before buying a home, you should attend the counseling sessions of the. Black and latinx communities, in particular, have long fallen prey to abusive lending practices.

If you know what to look for, you can avoid. The office is taking a comprehensive approach to addressing the problem of predatory. They should also explain any.

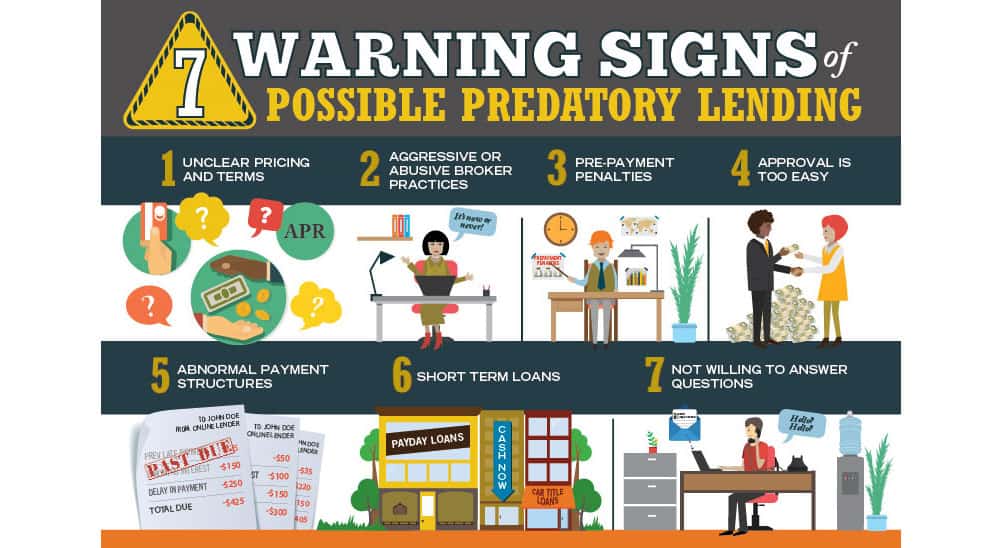

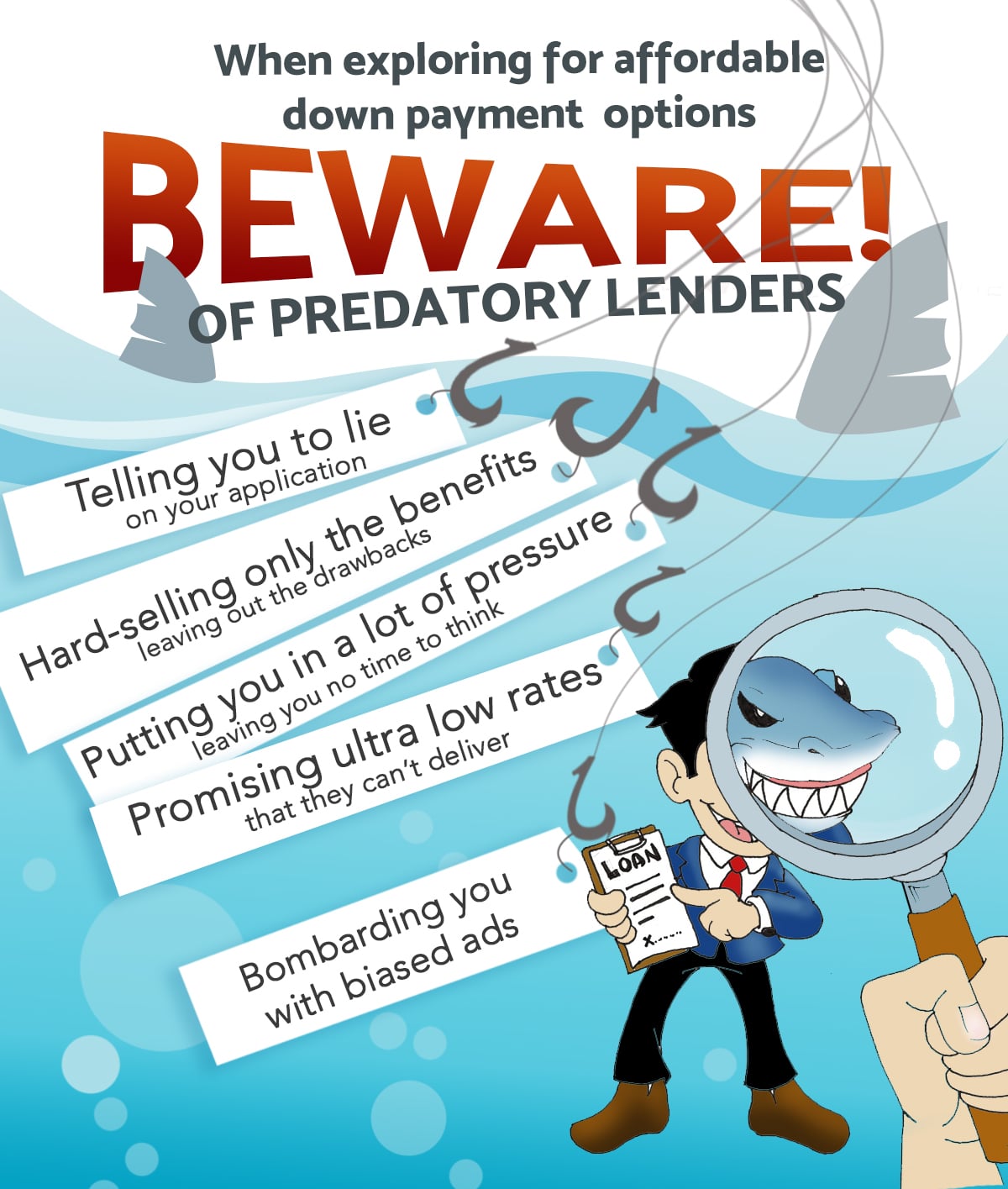

The key to avoiding being a victim of predatory lenders is awareness. How to avoid predatory lending practices. Warning signs of predatory lending.

You can't make your clients' lending decisions for them, but you can bring their attention to potential issues with. Being aware and knowledgeable about the terms and conditions of your loan gives you a powerful shield from predatory lenders. Tips for avoiding predatory lending.

If you find yourself in debt because of a predatory loan, it’s important to take action as soon as possible. Read all contracts carefully, paying close attention to interest rates and. Here are some tips to keep in mind:

The best way to avoid predatory lending is to increase your “financial literacy.” you can then apply your financial knowledge to help you more. Monthly payment, finance rate, length of the loan, default consequences, etc. The first step is to contact your lender and explain the situation.

It’s important to understand what predatory lending is and how to recognize the signs of a bad loan, so you can borrow responsibly. A primary defense against predatory lending is to become an informed consumer. Know what you can afford.

Read on to learn how you can sniff out predatory lending practices and avoid becoming the next victim. Predatory lending and payday loans. Have some idea what you should qualify for.

Before you start shopping for a loan, figure out how much debt you can reasonably manage to carry. To ensure you don’t fall prey to predatory lending, you must understand the warning signs. Legitimate lenders should fully disclose the true costs of a loan.