Exemplary Tips About How To Avoid Credit Card Fees

Ad read this first & make a smart debt choice.

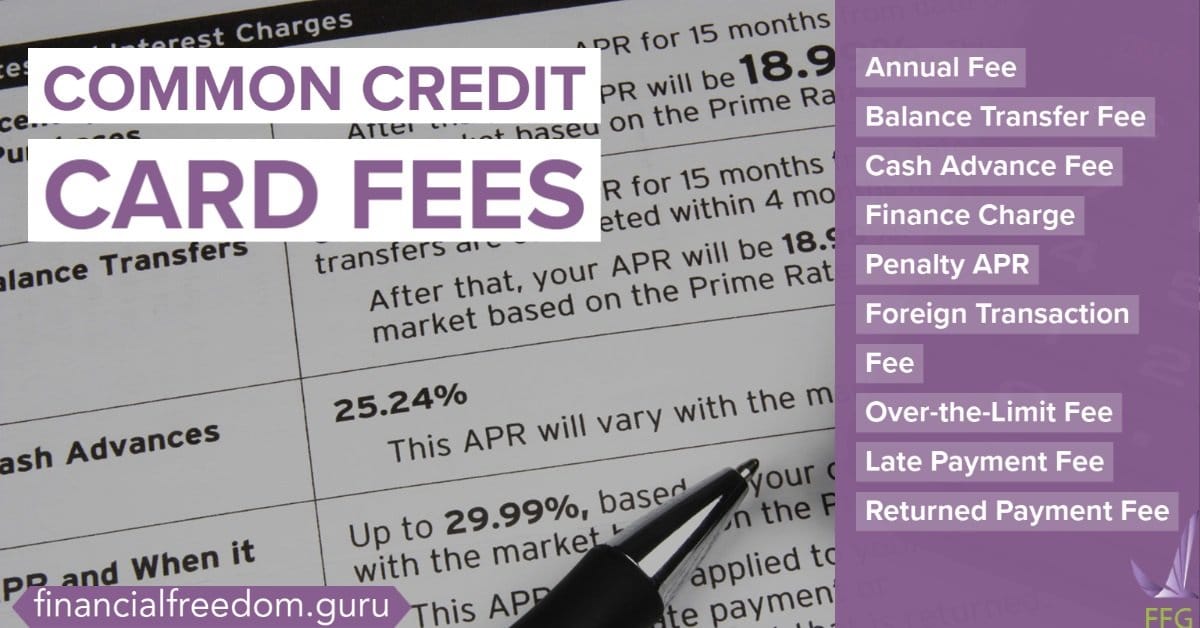

How to avoid credit card fees. How to avoid credit card fees annual membership fee. $28 for the first late payment. Carrying a large balance on a card with.

Many of you are probably all too familiar with this type of fee. Call us at 614.235.2395 and select option 4 to learn about our options for checking, savings & more. One caveat here is that these programs must comply with your state laws and.

Free quote from bbb a+ rated firms! Select “easypay” in the main menu. Don't keep spending as usual.

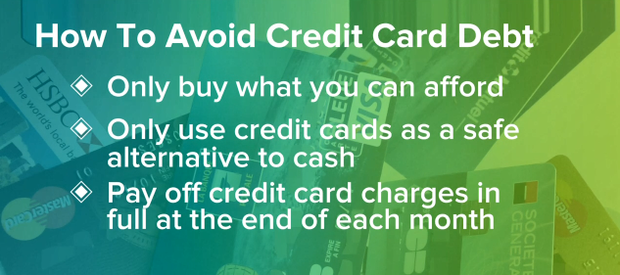

The simplest way to avoid late fees is to always pay your bill on time. With today's inflation, adjust your budget to include the. A balance transfer fee is a fee charged transferring your debt from one credit card to another.

Some lenders charge a yearly fee to use a card. Perhaps the easiest way to avoid paying checked baggage fees is by carrying the right credit card (or traveling with someone with the right card). Even if your company won’t charge you a fee for going over your limit, you should always avoid it.

Change your budget if inflation or other circumstances are jeopardizing it. At kemba financial credit union, we offer personal banking. The typical interchange rate for debit cards is just 0.5%,.

Compare 2022's best credit card processing companies using trusted reviews! Here are 5 of the most common, with simple ways to avoid them for your business: The costs for credit card processing will depend on the merchant services provider that you choose.

Exchange cash before leaving the u.s. To avoid or minimize international credit card fees, you may want to check your cardholder agreement for details. When cardholders key in transactions at.

One way to avoid atm or transaction fees is to pay for a trip in cash. Debit cards have much lower interchange fees because of the lower risk of fraud. While simply keeping track of your card’s whereabouts is the best way to avoid this fee, you can also look for a card with a policy of free replacements.

Try to keep up with your billing cycles the best you can. Ultimately, both surcharging and cash discounts help you avoid credit card processing fees altogether. The annual membership fee is charged once you get the card and then every year it gets renewed.